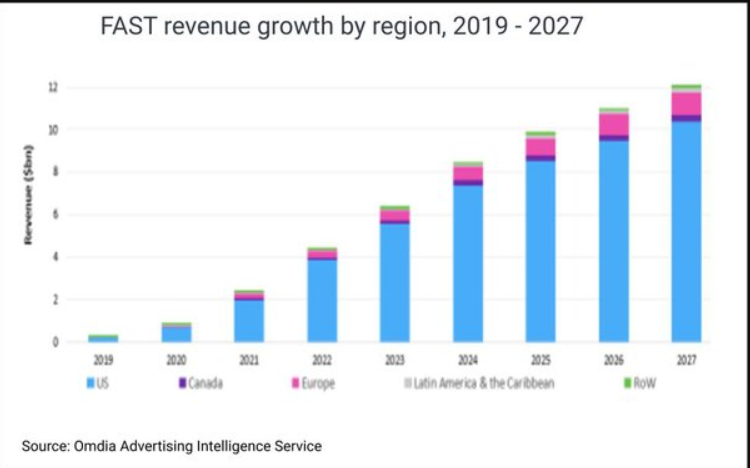

Omdia forecasts that free, ad-supported streaming TV channels will generate $6.3 billion in revenue worldwide in 2018 and $12 billion by 2027.

Between 2019 and 2022, FAST’s revenue increased by nearly 20 times, to just under $4 billion.

Currently, the United States accounts for nearly 90% of the global FAST market value.

By 2027, U.S. FAST revenue will exceed $10 billion, but the U.S. share will decline to 86% as FAST channels outside the U.S. exhibit the most rapid growth, generating $1.6 billion in revenue collectively.

The United Kingdom, Canada, Australia, and Germany will experience the most growth, followed by Brazil, Italy, Mexico, France, Spain, and Sweden.

By 2027, it is anticipated that the FAST markets in the United Kingdom and Canada, which benefit from an abundance of U.S.-generated content, will be worth over $500 million and $300 million, respectively.

In the same year, it is anticipated that Germany’s FAST channels will generate slightly more than $200 million, while Brazil’s FAST channels will generate $100 million, representing roughly half of the estimated $207 billion total Latin American FAST market. Mexico is projected to generate $93 million by 2027, making it the seventh-largest individual FAST market.

Maria Rua Agueta, a senior director at Omdia, notes that despite FASTs’ impressive growth curve, its development will trail that of social video.

“FAST channels are an additional opportunity to monetize content, but not the only one,” explains Aguete.