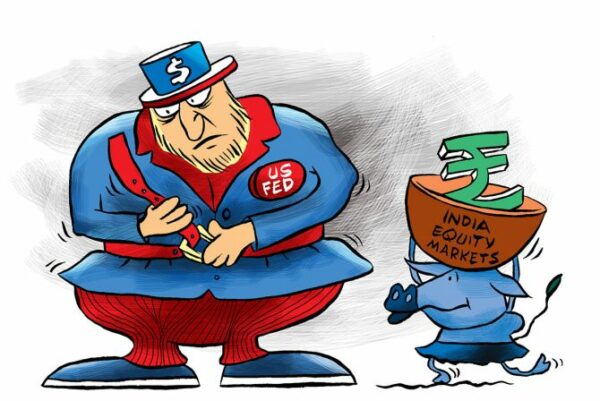

Global equities markets have suffered from central bank tightening, notably the US Federal Reserve.

According to Puneet Wadhwa/Business Standard, Jefferies managing director Mahesh Nandurkar expects rising rates to affect markets within six months and maybe by the fourth quarter of 2023.

How will global equity perform in CY23? How likely is a Fed rate cut in the second half of CY23/early CY24?

Fed rate cuts this year seem improbable. Rates may rise 25-50 basis points soon.

The Fed rate will peak at 5.1-5.3 percent in the second quarter of CY23 and stay there until rate reduction begin in CY24.

Higher rates may affect global equities markets in six months or by Q4 of CY23.

Only in CY24 will they begin to consider rate reduction.

Indian stocks have had a rough CY23. Do you believe they can catch up with their worldwide counterparts in the next several months or stay behind?

India was among the best-performing stock markets in CY21 and CY22, but underperformance in late CY22 and early CY23 has brought relative values near to the historical norm.

India trades at a 60% premium to the developing market index, but that’s typical. India is now affordable.

India benefits from global geopolitics.

India’s underperformance may be over.

Indian equities may beat global rivals in the second half of this year.

Do you foresee populist moves from the administration ahead of state elections and the federal election next year? Will markets react?

I think the administration has done a terrific job of avoiding populism and focusing on investment and capital spending, which will help the Indian economy thrive long-term.

Yet, as we approach the 2024 national elections, any administration would naturally prioritize social programs, as has always been the case.

Rural communities may spend more than expected due to El Nino, which reduces India’s rainfall.

These changes won’t hurt India’s growth or markets.

Does the market foresee additional Adani Group scandals, or does it think the worst is over?

According to bank pronouncements, India’s banking and financial system stability may not be affected.

India’s GDP growth prospects shouldn’t be affected.

What did the October-December corporate earnings season teach you?

The 2022-23 October-December quarter season went as predicted.

Throughout results season, FY23 and 2023-24 profit forecasts were unchanged.

Consumer discretionary demand (durables, food services, retail) was sluggish, although margins were higher than predicted.

Better net interest margin boosted banking and non-bank financial enterprises’ profitability.

When raw material pressure eased, automotive businesses reported favorable surprises in margins.

Which Indian sectors are overweight or underweight? Dark horses?

Financials, industrial, capital goods, staples, and real estate remain overweight as we prefer domestic recovery plays.

IT services, pharmaceuticals, cement, and consumer discretionary are underweight.

Property developers are a dark horse since their stock prices have not kept pace with the underlying increase in volumes and pricing.

The industry could gain until increasing rates eliminate the emotional overhang.